Green cryptocurrencies

What are green cryptocurrencies and why are they important?

Cryptocurrency mining is a process that usually involves high energy consumption, due to the complex levels of computation required. In order to minimise the carbon footprint associated with the first digital currencies, alternative models with a low environmental impact have been developed: the so-called green cryptocurrencies.

Sustainability is increasingly becoming a central criterion for the future of the blockchain industry. Achieving a cryptographic mechanism that is not only effective, but also efficient is essential to further expand the use of blockchain-based cryptocurrencies. To analyse the energy efficiency of a particular cryptocurrency, it is necessary to inspect its process of creating and maintaining blocks of information: how the users of that currency have agreed to record and validate the information contained in each block of the distributed database.

Almost all of the most popular cryptocurrencies - such as Bitcoin, the original cryptocurrency created in 2009 - are produced through mining. This is precisely the process that the new green cryptocurrencies want to rethink in order to reduce their disproportionate energy consumption. An inefficient energy expenditure, with its associated greenhouse gas emissions, opposed to the founding purpose of digital currencies to create a more accessible, fair and sustainable system than traditional government-controlled currencies.

What is cryptocurrency mining?

The control of each cryptocurrency or digital currency works through a decentralised database, usually a blockchain, which serves as a kind of public financial ledger. The information in this database is not stored on a single computer, but on multiple terminals connected to each other via the internet - so-called nodes - that distribute the updated information in real time.

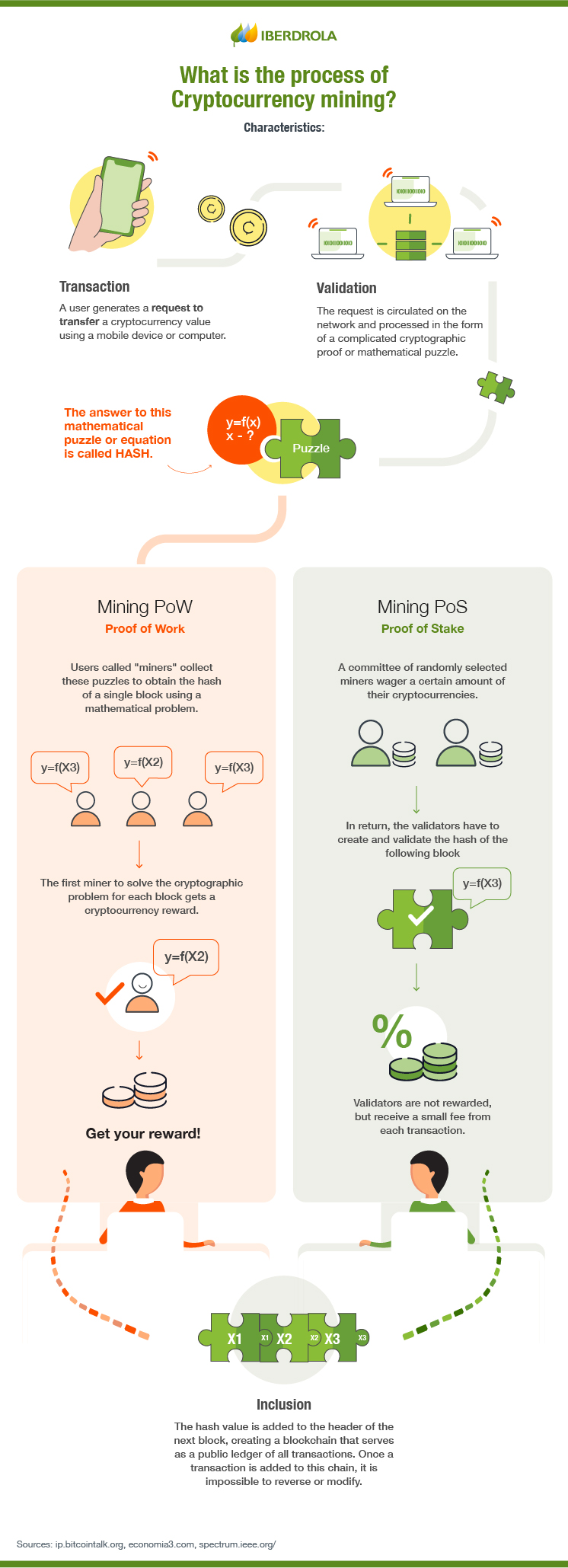

The transactions included in each block are controlled by high-powered computers and a complex validation protocol referred to as data mining. This validation process is based on consensus: because everyone in the network has access to the same information, everyone believes it to be true. A system that makes it possible for data to be recorded in unique blocks of information and interlinked, making it easy to retrieve and verify at any time.

Data mining encompasses a set of techniques aimed at extracting actionable and implicit knowledge from databases. The basis for mining cryptocurrencies lies in artificial intelligence and statistical analysis.

Bitcoin energy consumption

The Bitcoin business alone is estimated to have an annual electricity consumption of more than 198 terawatt-hours (TWh), comparable to that of countries such as Thailand. An electro-intensive use that translates into almost 95 million tonnes of CO2 per year, comparable to the emissions of nations such as Nigeria, according to Digiconomist's Bitcoin Energy Consumption Index. These rising figures are confirmed by other studies such as that of the Judge Business School at Cambridge University, and they were the focus of media attention by Tesla CEO Elon Musk, who announced in May 2021 that his electric car company will no longer accept bitcoin as payment.

Why does Bitcoin have such a high energy consumption? The main cause is an inefficient mining system or consensus mechanism, known as Proof-of-Work (PoW). To verify transactions within its decentralised structure, Bitcoin requires computers dedicated to mining cryptocurrencies to solve increasingly complex mathematical problems. Many miners compete simultaneously to see who can certify a transaction first and, as a reward, get paid in the form of bitcoins.

As more people compete to solve these mathematical problems, they automatically become more and more complex, which in turn means that the miners need to pour in greater amounts of electrical and computational energy to reap the rewards. Energy that is completely wasted in the case of the hundreds of thousands of computers that fail to come first in the competition.

SEE INFOGRAPHIC: Cryptocurrency mining processes [PDF]

SUSTAINABLE SOLUTIONS FOR BITCOIN AND OTHER CRYPTOCURRENCIES

Emerging green cryptocurrencies are based on new mechanisms that reduce the carbon footprint of blockchain technology. Many of these aspects can also be applied to existing, more polluting cryptocurrencies, in search of solutions towards greater sustainability. This is the case of Ethereum - the system behind most non-fungible tokens (NFT) - which plans to reduce its energy consumption by 99.5% by relying on a Proof-of-Stake (PoS) consensus mechanism.

While it is a challenge to add the attribute of sustainability to the complex balance that cryptocurrencies pursue between decentralisation, security and scalability, experts suggest some keys to greening a cryptocurrency:

| Transition to renewable energies

| Transition to renewable energies

It is an obvious first response to correct the carbon emissions figures generated in the cryptocurrency industry. In 2021, less than 40% of the bitcoins verified by Proof of Work were mined with renewable energy sources. This is why numerous start-ups have emerged with different proposals to address this gap.

| From the Proof of Work to the Proof of Participation

| From the Proof of Work to the Proof of Participation

The Proof-of-Stake (PoS) consensus mechanism requires miners to advance a small amount of cryptocurrencies to enter a lottery where they opt to be assigned transactions to verify. This lowers the risk of them approving fraudulent transactions, while eliminating the competitive computational element of Proof-of-Work, allowing each machine to work on a different problem and optimising the energy consumed.

| Integrating "pre-mining"

| Integrating "pre-mining"

Pre-mining works in a similar way to fiat currencies or company shares: a central authority creates a certain amount of the good in question, in this case cryptocurrencies, and puts it into circulation according to its global and business context. In these systems, transactions are still verified by a decentralised network of miners before being added to the blockchain registry, although users involved in the transaction may have to pay them a small fee to compensate for this work.

| Introducing carbon credits

| Introducing carbon credits

The application of state carbon credits for cryptocurrency mining companies could lead to them buying carbon credits from other companies, helping to offset the amount of emissions created globally, or switching to greener energy in order to sell their own credits

MAIN GREEN CRYPTOCURRENCIES

Five of the most popular green cryptocurrencies are gaining popularity:

- Chia (XCH)

- Cardano (ADA)

- Nano (NANO)

- Stellar Lumens (XLM)

- Algorand (ALGO)