Climate change risk management

Committed to transparency in risk management and the opportunities arising from climate change

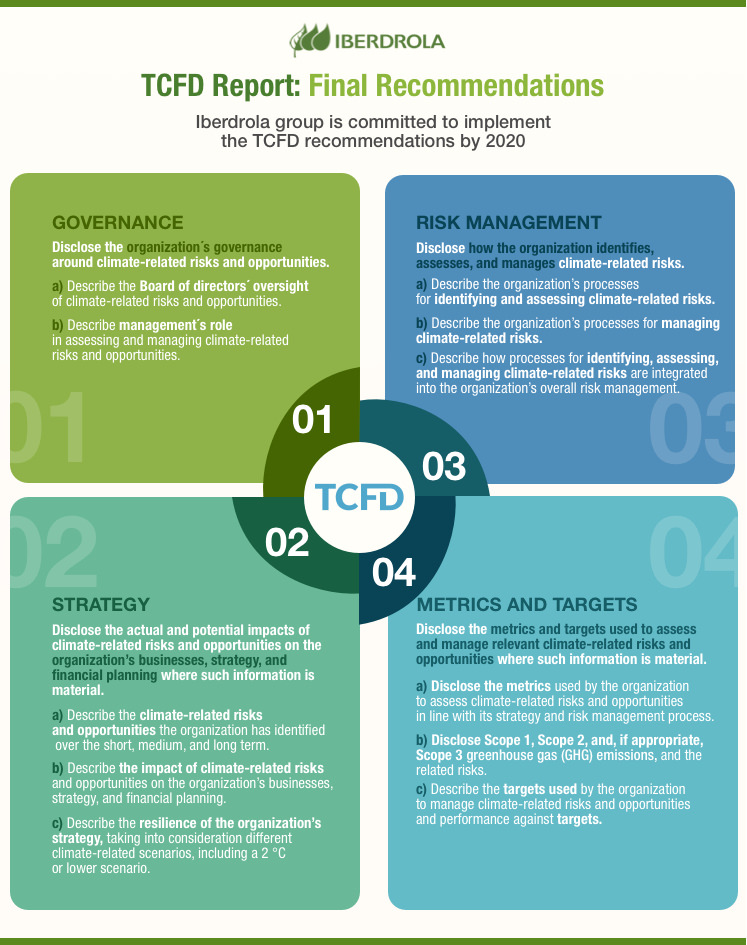

The Financial Stability Board (FSB) created the Task Force on Climate-related Financial Disclosures (TCFD) in 2015, which is a working group to encourage companies to inform their investors about the risks related to climate change and the way in which they are managing them. Here, we present the progress made by Iberdrola in implementing the 11 recommendations prepared by this organisation.

In a context in which an increase in the physical impacts due to extreme climatic events is foreseen throughout the world, as well as significant changes (regulatory, economic, industrial, etc.) brought by the transition towards a decarbonised economic model, pressure is growing from investors and public bodies for companies to report on how they manage the risks and opportunities that arise from climate change.

The publication in 2017 of the recommendations by the Task Force on Climate-related Financial Disclosure (TCFD) External link, opens in new window. was a milestone in this move towards greater climate transparency. It was promoted by the Financial Stability Board (FSB), an international organisation created by the G20 to supervise the smooth functioning of the financial system. The objective of these guidelines is to improve transparency on the risks related to climate change and the usefulness of this information for the financial sector, allowing it to take into account the risks related to climate and the way in which each organisation is managing them.

External link, opens in new window. was a milestone in this move towards greater climate transparency. It was promoted by the Financial Stability Board (FSB), an international organisation created by the G20 to supervise the smooth functioning of the financial system. The objective of these guidelines is to improve transparency on the risks related to climate change and the usefulness of this information for the financial sector, allowing it to take into account the risks related to climate and the way in which each organisation is managing them.

SEE INFOGRAPHIC: TCFD report: Final recommendations [PDF] External link, opens in new window.

There is growing support [PDF] External link, opens in new window. for these recommendations. Currently, nearly 800 companies from a wide range of sectors have committed themselves to implementing them, while 340 investors with almost 34 trillion dollars in assets and 36 central banks and supervisors are encouraging their use.

However, it is not an isolated initiative. At European level, one of the lines of work in the Sustainable Finance Action Plan [PDF] External link, opens in new window. presented by the European Commission relates to reporting [PDF] External link, opens in new window. on climate change and this will also form part of the next European Directive on non-financial information. Likewise, sectors as influential as rating agencies and sustainability indices are increasingly aware of this global challenge and are developing methodologies to assess both the exposure and vulnerability of companies and the level of management that exists.

Progress made by Iberdrola Group

Iberdrola was one of the first companies to publicly commit itself to implementing the TCFD recommendations in its public reports for 2020. In fact, in its Statement of Non-Financial Information 2018 (Sustainability Report) it devoted a section [PDF] External link, opens in new window. to reporting its alignment with these guidelines and the progress made. Iberdrola created a multidisciplinary internal work group in 2017 which coordinates all the work carried out in this area.

Corporate Governance

In 2018, the company's Board of Directors undertook a major reform of the Corporate Governance System to reinforce the group's commitment to the UN's Sustainable Development Goals, especially numbers 7 — affordable and clean energy — and 13 — climate action —. In addition, the Board reviews the Group's Climate Action Policy, and the long-term incentive plan for executive directors is linked to the achievement of both SDGs.

Strategy

Climate change is a key element in defining the company's strategy. Iberdrola is addressing it not only as a risk factor, but also as an opportunity for growth through mitigation and adaptation actions during the transition to a low carbon economy.

During 2018, Iberdrola carried out an analysis exercise covering different future scenarios, which demonstrates that the group's business model is adequate to face the challenges arising from the energy transition, as well as the physical impact of climate change. In order to face the former — transition — the company has its strategy and positioning in renewable energy, disinvestment in oil- and coal-fired power plants and investment in smart grids.

In the case of the latter — the physical impacts derived from the main climatic threats and the increase in the frequency and severity of extreme weather events —, Iberdrola has predictive plans and systems to minimise their impacts. One example is Transforming Energy, an Avangrid Networks plan for the next 10 years aimed at improving the network's resilience in the face of severe storms.

Risk Management

The group's risk control and management system considers and monitors the risks derived from climate change, which can be grouped into:

- Physical: possible material impacts on installations.

- Transitional: associated with the process of global decarbonisation (regulatory changes, market prices, technological, reputational, etc.).

- Others: such as risks to the supply chain and social phenomena.

Iberdrola does not foresee that these risks will have a catastrophic or permanent impact on the group's consolidated figures to 2040. In addition, the opportunities that the company derives from the decarbonisation of the global economy are greater than the risks, thanks to its leadership position in renewable energies, smart grids, storage and digitalisation.

Metrics and targets

Iberdrola includes relevant indicators relating to climate and its strategy to combat climate change in its Sustainability Report [PDF] External link, opens in new window. and in the Integrated Report. These include indicators on its greenhouse gas emissions inventory, emissions intensity, reduction objectives, energy use, energy intensity, the energy mix, installed renewable capacity, water use, the origin of its water, R&D&i and investment in developing low emissions products, services and/or technology.

State of implementation and best practices

In addition, the Iberdrola group has participated — together with other electricity companies (CLP, EDF, EDP, EnBW, Enel) — in a report promoted by the World Business Council for Sustainable Development (WBCSD) on the disclosure of financial information on climate change aligned with the TCFD in the electricity sector.

The report reflects how the companies are implementing the recommendations and offers examples of best practices on the information they are currently providing as well as identifying areas for development. It also explores some of the challenges the companies face in responding to the TCFD's recommendations and the expectations of the users of this information, mostly from different financial sector agents, from investors to rating agencies and insurance companies.

"For Iberdrola, the TCFD framework is a valuable tool instrument to showcase how we integrate climate change at all levels of the organization as well as align with a decarbonization pathway that mitigates risks and promotes opportunities", explains Carlos Sallé, Iberdrola group director of Energy Policies and Climate Change.

Ethics, transparency and good governance