Director Remuneration Policy

The remuneration of Iberdrola's directors should be commensurate with the dedication and responsibility assumed by them

Director Remuneration Policy

17 May 2024

1. Introduction. Changes to the Policy from the previous one

The Board of Directors of Iberdrola, S.A. (the “Board” or the “Board of Directors”) recognises that the strategic decision-making skills of the directors and officers and their unwavering commitment to the Purpose and Values are the fundamental factors in the sustained leadership of Iberdrola, S.A. (“Iberdrola” or the “Company”) year after year. The combination of experience, talent, dedication, innovation and leadership commitment of the directors, officers and professionals of Iberdrola constitute its competitive advantage, and it is from this perspective that the Remuneration Committee approaches the preparation of the new Director Remuneration Policy (the “Policy” or “Remuneration Policy”); a strategic tool to maintain Iberdrola’s leadership in the energy sector.

Iberdrola’s Remuneration Policy is intended to attract, retain, motivate and develop the best talent, providing incentives for the creation of sustainable value and the achievement of corporate goals to ensure maximum alignment with the stakeholders, in accordance with the provisions of other policies. However, what sets Iberdrola apart is the manner in which the Policy is put into practice, with notable consistency and continuity over the years, which has made it possible to provide clarity to its directors and officers regarding what is expected of them with respect to the fulfilment of the strategic goals and the principles to which they must adhere in order to achieve them.

This Policy, among others, has helped Iberdrola to significantly increase its international presence, operating in multiple markets, and to become a global player in the energy sector, where Iberdrola has generated €75 billion in value as a result of tripling its capitalisation and distributing dividends of more than €25 billion since 2013. Total shareholder return (TSR) is significantly higher than the Euro STOXX 50, the Euro STOXX Utilities and the Ibex-35. All of the foregoing guarantees the long-term sustainability of the Company.

Pursuant to the provisions of the Companies Act (Ley de Sociedades de Capital), every three years the Remuneration Committee engages in an exhaustive review of the Remuneration Policy to ensure that the principles, content and disclosures are in line with the expectations of its shareholders and proxy advisors and with best market and corporate governance practices.

This review process takes into consideration the following issues, which derive from the action plan for continuous improvement developed by the Remuneration Committee:

- Information gathered annually through the Company’s ongoing and transparent dialogue with its shareholders and proxy advisors regarding expectations with respect to the Policy and potential modifications.

- Results of the annual analysis of best remuneration practices at comparable companies and global companies with the advice of an independent expert.

- Best corporate governance practices.

The general lines of the new Remuneration Policy are consistent with those of previous years, although, taking into account certain significant milestones that have occurred since the last revision of the Policy, such as the separation of the duties of the executive chairman and chief executive officer, the approval of the Strategic Bonus aimed at professionals of companies of the Iberdrola group for the 2023-2025 period, and the strategy of Iberdrola communicated to the markets at the Capital Markets & ESG Day held on 9 November 2022, the following changes to the Policy as a strategic tool for the creation of sustainable value for all the stakeholders have been introduced:

For directors in their capacity as such:

- The fixed remuneration of the directors in their capacity as such, which has remained unchanged since 2008, is updated to ensure that it is in line with the increase in responsibilities and workload, as well as the size and complexity of the Company and to be competitive for the creation of value and the attraction and retention of qualified professionals with significant international experience.

For directors in their capacity as such, a shareholding policy has been established requiring an amount equivalent to at least 20% of annual fixed remuneration to be maintained for a period of four years.

For officers:

- The maximum limit of short-term variable remuneration (annual bonus) is reduced from 200% to 150% of fixed remuneration.

- As regards clauses for the cancellation or clawback of amounts already paid as short- and long-term variable remuneration, the Board of Directors is empowered to cancel or claw back the variable components of remuneration in the event of a material restatement of the financial statements that is not due to a change in accounting laws or regulations, as well as in situations of fraud or serious violation of law declared by a final court judgement.

- The period during which the shares received may not be transferred (shareholding policy) is set at four years unless an amount equal to twice their fixed remuneration is maintained.

2. Object and scope of application

At its meeting held on 19 March 2024, Iberdrola’s Board of Directors, upon a proposal of the Remuneration Committee, resolved to submit this Director Remuneration Policy for the approval of the shareholders at the General Shareholders’ Meeting 2024 as a separate item on the agenda, in compliance with the provisions of Section 529 novodecies of the Companies Act.

The purpose of this Policy is to establish the framework governing the remuneration of directors in their capacity as such and officers who are directors, taking into account various factors such as economic volatility and geopolitical tensions, among other things. The Policy is intended to promote appropriate remuneration principles and practices throughout the group in order to contribute to the achievement of the Company’s long-term strategic and sustainability goals, as well as to define the procedure for determining the revision and implementation thereof.

This Policy shall apply to the remuneration of all members of the Company’s Board of Directors and, if approved by the shareholders at the General Shareholders’ Meeting, shall apply as from the approval hereof and during financial years 2025, 2026 and 2027.

3. Principles of the Policy and remuneration practices

3.1. Principles of the Policy

The Board of Directors has found that proper strategic decision-making and a clear commitment to the corporate values are two of the main factors determining the performance of companies, particularly in the energy sector. Companies may choose similar businesses, markets and technologies, yet their performance is different. Thus, experience, talent, effort, innovation, leadership and the ability to realise the commitment to its Purpose and Values are the main differentiating elements.

The Purpose and Values of the Iberdrola group define the Company as a driver of an energetic, electric, efficient, healthy and accessible model, fully aligned with financial and non-financial objectives relating to sustainable development and consistent with the highest environmental, social and corporate governance standards and requirements. This is all within the general framework of respect for and protection of human rights, the social market economy, sustainability and generally accepted ethical principles.

Therefore, the ultimate goal of this Policy, like that of the remuneration programmes for the Iberdrola group’s professionals, is to contribute decisively to the attraction, retention, motivation and development of the best talent, on fair and competitive terms, which is the best way to contribute to the business strategy and to the interests and long-term sustainability of the Company and of the Iberdrola group, as well as its stakeholders, including the shareholders.

For directors in their capacity as such:

The principles governing the Remuneration Policy are the following:

Principles of the Policy

- Transparency

- The Remuneration Committee assumes a commitment to enforce the principle of transparency of all the items of remuneration received by all directors, providing complete, relevant and adequate information in line with the good governance recommendations generally recognised in international markets in the area of director remuneration.

- Non-discrimination

- The Remuneration Committee endeavours to ensure non-discrimination, at all times ensuring non-discriminatory remuneration in terms of gender, age, culture, religion, race or any other issue.

- Alignment with the remuneration policy for the Company’s professionals

- The Policy shares the same principles and goals as the remuneration policy for all of the Company’s professionals: to contribute decisively to attracting, retaining, motivating and developing the best talent on fair and competitive terms.

- Competitiveness for the creation of value

- Properly reward the dedication and responsibility assumed by the directors to maximise value creation and the commitment to the Company’s Purpose and Values.

Ensure that the structure and total amount of remuneration maximises the social dividend and shareholder return and the achievement of the Company’s long-term sustainability.

Comply with best practices by being competitive with comparable global companies in terms of capitalisation, turnover, complexity (including risk management and internal control), sustainable ambition, ownership structure and international presence within the framework of its commitment to all stakeholders.

- Properly reward the dedication and responsibility assumed by the directors to maximise value creation and the commitment to the Company’s Purpose and Values.

- Remuneration system without variable remuneration

- Link remuneration to effective dedication, the responsibilities assumed and the performance of their duties as directors, without participating in remuneration formulas linked to the Company’s long-term results or to short-term personal performance.

For officers:

- Neutrality in variable remuneration for the creation of value

- The Remuneration Committee shall endeavour to ensure that the accrual of variable remuneration of any kind is not based merely on the general performance of the markets, of the industry in which the Company operates, or on other similar circumstances, thus endeavouring to ensure the effective creation of value.

- Long-term commitment to the interests of the shareholders and to sustainability

- Foster and encourage the attainment of the strategic goals of the Company through the inclusion of annual variable remuneration and long-term incentives to align the interests of officers with those of the shareholders, while strengthening continuity in the competitive development of the group, generating motivation and loyalty.

- Proportionality to risk measures in the remuneration systems

- Set maximum limits to any variable remuneration as well as suitable mechanisms in order for the Company to be able to cancel (“malus” clause) or obtain reimbursement (“clawback” clause) of the variable components of remuneration.

The Company’s Board of Directors can cancel or claw back the variable components of remuneration in the event of a material restatement of the financial statements that is not due to a change in accounting laws or regulations, as well as in situations of fraud or serious violation of law declared by a final court judgement.

- Set maximum limits to any variable remuneration as well as suitable mechanisms in order for the Company to be able to cancel (“malus” clause) or obtain reimbursement (“clawback” clause) of the variable components of remuneration.

3.2. Remuneration practices

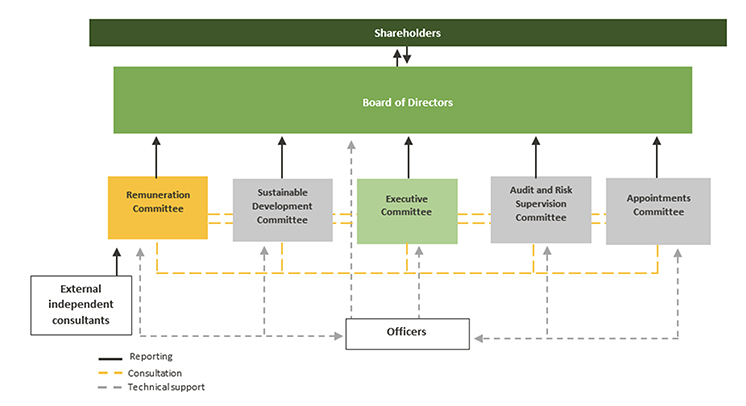

In its decision-making process, the Remuneration Committee actively listens to the shareholders (both retail and institutional) and proxy advisors, the opinion of independent external advisors, together with the experience and expertise present in other committees of the Board of Directors, as well as the technical support of the officers.

To ensure the effectiveness of the Remuneration Policy through a cross-cutting approach, the Remuneration Committee applies the principles described above via the following remuneration practices:

Remuneration practices

- Establish a sustainable remuneration system that is not based on the short term

- The Remuneration Committee promotes a long-term sustainable remuneration system and maintains a reasonable balance between the various elements making up remuneration, reflecting an appropriate assumption of risk that contributes to attracting, retaining, motivating and developing the best talent.

- Active and responsive listening

- The Remuneration Committee takes into consideration the information received from the Company’s shareholders (both retail and institutional) and proxy advisors, as well as an analysis of their main expectations.

- Consider competencies present in other committees

- In the performance of its duties, the Remuneration Committee works proactively and in consultation with other committees, particularly the Audit and Risk Supervision Committee, the Sustainable Development Committee and the Appointments Committee.

- Shareholding policy

- For directors in their capacity as such, a shareholding policy has been established requiring an amount equivalent to at least 20% of annual fixed remuneration to be maintained for a period of four years.

- No guaranteed remuneration

- There are no contracts with guaranteed remuneration (salary increases or variable remuneration).

- No loans or advances

- No loans or advances are given to directors.

- No long-term savings schemes (pensions)

- There are long-term savings schemes for officers who are not directors, but no long-term savings scheme has been established for directors in their capacity as such.

For officers:

- Defer the payment of long-term variable remuneration

- The delivery of shares under the long-term variable remuneration system is paid in thirds on a deferred basis over a three-year period, with no overlap of plans.

- Shareholding policy

- Ownership of the shares received may not be transferred for a period of four years unless an amount equal to twice fixed remuneration is maintained.

- No share delivery plans with capital increases

- Share delivery plans are not implemented by means of capital increases or similar instruments.

- No hedging transactions

- Hedging of the Company’s share-based remuneration plans is not authorised.

Hedging, pledging or short-selling of or derivatives contracts on shares received in variable remuneration schemes is not permitted.

- Hedging of the Company’s share-based remuneration plans is not authorised.

- No overlapping long-term incentive plans

- No annual awards of long-term variable remuneration can be made if there is an overlap.

4. Structure of remuneration

4.1. Directors in their capacity as such

The remuneration to which directors are entitled in their capacity as such is structured in accordance with the following sections within the framework of legal and by-law provisions:

4.1.1. Maximum aggregate amount

The maximum aggregate amount of annual remuneration to be paid to the directors as a whole in their capacity as such is €9,000 thousand in each financial year in which this Policy is in effect, which includes:

- Fixed remuneration and attendance fees.

- Benefits.

- Commitment not to compete.

This aggregate maximum amount has remained unchanged since 2008.

4.1.2. Fixed remuneration and attendance fees

From 2013 to 2023, Iberdrola notably increased its international presence, operating in multiple markets, and becoming a global player in the energy sector, and it has generated €75 billion in value as a result of tripling its capitalisation and distributing dividends of more than €25 billion. Total shareholder return (TSR) is significantly higher than the Euro STOXX 50, the Euro STOXX Utilities and the Ibex-35. All of the foregoing guarantees the long-term sustainability of the Company.

From 2008 until 2023, the Board of Directors, upon a proposal of the Remuneration Committee, unanimously decided to maintain unchanged the amounts of fixed remuneration of the directors in their capacity as such. During this period, the level of dedication and responsibility assumed by the members of the Board of Directors has increased considerably, mainly due to increased regulatory requirements and the complexity of the topics discussed at the meetings of the Board and its committees, which has required more preparation time for each meeting.

For financial year 2024, and after performing a benchmark analysis, it is proposed to update the annual fixed remuneration to ensure that it is in line with the increase in responsibilities and workload, as well as the size, international nature and complexity of the Company and to be competitive for the creation of value and the attraction and retention of qualified professionals with significant international experience.

(*) Not cumulative with previous positions

Reducing attendance fees for attending meetings of the Board of Directors and its committees (**):

(**) The Regulations of the Board of Directors provide that the Board of Directors must meet at least 8 times per year and the Executive Committee meets on average 12 times per year. The regulations of each of the committees provide for a maximum of seven meetings per year, except for the Audit and Risk Supervision Committee.

The Board of Directors is responsible for determining the annual fixed remuneration of the directors in their capacity as such, within the aggregate maximum amount, taking into account the positions held by each director on the Board of Directors and the membership thereof on delegated or consultative bodies of the Board of Directors, as well as their dedication to the Company.

The fixed remuneration for membership on the Board of Directors and the committees thereof and the holding of positions on such bodies is compatible with and independent from the remuneration to which the officers that are directors are entitled for the performance of their executive duties as provided in Section 4.2. of the Policy.

4.1.3. Benefits

- Risk benefits

- The Company pays the premiums under insurance policies that it has taken with certain insurance companies for the coverage of the death or disability of directors caused by accidents, and the Company itself assumes coverage of benefits for the death or disability of directors due to natural causes.

- Civilliability

- The Company pays the premiums under insurance policies providing coverage against civil liability deriving from holding the office of director, if applicable, obtaining a policy in common with the other officers of the group, on standard market terms and proportional to the circumstances of the Company itself.

- Electricity rate

- The directors in their capacity as such, as well as the rest of the Company’s professionals, are entitled to limited electricity discounts through rate concessions.

4.1.4. Shareholding policy

For directors in their capacity as such, a shareholding policy has been established requiring an amount equivalent to at least 20% of annual fixed remuneration to be maintained for a period of four years.

4.1.5. Commitment not to compete

A director who ends the term of office to which the director was appointed or who, for any other reason, ceases to act as such, may not be a director or officer of, or provide services to, any entity whose object is similar, in whole or in part, to that of the Company or which is a competitor of the Company, for a term of two years. The Board of Directors may, if it deems it appropriate, relieve the outgoing director from this obligation or shorten the period thereof.

In the case of cessation of office of a non-executive director who is not a proprietary director (that is not due to a breach of director duties attributable to the director) prior to the end of the period for which they were appointed, the Board of Directors may ultimately resolve to provide compensation for an agreement not to compete.

The above circumstance must be justified and explained in the Annual Director and Officer Remuneration Report.

4.2 Officers

4.2.1. Remuneration mix

The principles of the Policy are implemented through an appropriate remuneration mix that includes:

- Fixed remuneration.

- Short-term variable remuneration (annual bonus).

- Long-term variable remuneration (strategic bonus).

- Benefits.

It is designed to attract, retain and motivate the best talent and align their performance with the interests of the Iberdrola group and the achievement of its business strategy, promoting its long-term sustainability, in accordance with best practices at the domestic and international level.

When determining the proportion of each element of total remuneration (remuneration mix), the Remuneration Committee continuously monitors market practices and trends.

The specific weights of each element of the remuneration mix for each financial year shall be identified in the corresponding Annual Director and Officer Remuneration Report.

Those corresponding to financial year 2024:

Executive chairman

Maximum

81 % Pay for performance Remuneration linked to the achievement of targets with malus and clawback clauses

Minimum

Chief Executive Officer

Maximum

76 % Pay for performance Remuneration linked to the achievement of targets with malus and clawback clauses

Minimum

Other officers

Maximum

72 % Pay for performance Remuneration linked to the achievement of targets with malus and clawback clauses

Minimum

4.2.2. Fixed remuneration

The remuneration of the officers may vary based on the specific responsibilities and nature of the functions performed and are reviewed annually by the Board of Directors upon a proposal of the Remuneration Committee, particularly taking into account, without limitation, the following factors: the financial position of the Company, market standards, their calibre and merits, the risks of retention and general salary updates within the Iberdrola group. For these purposes, the Remuneration Committee may rely on external advisors to perform the market studies and analyses that it deems appropriate.

In 2024 the annual fixed remuneration for the executive chairman is €2,250 thousand and for the chief executive officer is €1,000 thousand. The fixed remuneration of the executive chairman has remained unchanged since 2008 and that of the chief executive officer has remained unchanged since his appointment on 25 October 2022.

The Board of Directors, at the proposal of and following a reasoned report from the Remuneration Committee, has the ability to revise the fixed remuneration during the term of this Policy.

4.2.3. Short-term variable remuneration (annual bonus)

- Purpose

- A portion of the annual remuneration of the officers is variable, in order to incentivise the achievement of the Company’s annual objectives and those specific to the position, aligning dedication and efforts with the business strategy.

- Metrics

- Annual variable remuneration is linked to the achievement of strategic, quantitative and qualitative, predetermined, specific, quantifiable, challenging and clear objectives aligned with the Purpose and Values, the achievement of the business strategy and the long-term economic/financial interests and sustainability of the Company, growth (operational/industrial) and other non-financial objectives relating to sustainable development.

- The pool of targets to which short-term variable remuneration will be linked relates to parameters such as the following:

- Economic / Financial

- Net profit, gross operating income (EBITDA), cash flow, etc.

- Investments.

- Evolution of shareholder remuneration in comparison with other values and indices.

- Financial strength.

- Efficiency level of the group.

- Growth

- Selection and implementation of investments.

- Project portfolio.

- Non-financial relating to sustainable development

- Development and application of the Stakeholder Engagement Policy, the Policy on Respect for Human Rights, and the commitment to the social dividend.

- Development of the Diversity and Inclusion and Anti-Harassment Policy.

- Results in the fight against climate change.

- Management of corporate reputation, measured in terms of presence in sustainability and ethics indices.

- Training of the group’s professionals.

- Resiliency and reinforcement of cybersecurity plans.

- Levels of occupational safety, health, well-being and labour climate.

- Economic / Financial

- Each metric has a related achievement scale where a minimum threshold and an upper limit are set. If the minimum performance level is not reached, no annual variable short-term remuneration will accrue. For each of the metrics, any intermediate results will be calculated by linear interpolation.

The specific weights and parameters for each financial year to which the short-term variable remuneration will be linked are published in the corresponding Annual Director and Officer Remuneration Report.

- Maximum amount

- The maximum limit of the annual variable remuneration is set at 150% of the fixed remuneration, which will be reached in the event of 100% achievement.

For the executive chairman, the Board of Directors has resolved to maintain the same level for 2024 as in 2023, with the maximum limit of annual variable remuneration being 144% of the annual fixed remuneration, which will be reached in the event of 100% achievement of the established objectives, which is lower than the maximum established limit.

For the chief executive officer, the Board of Directors has resolved to maintain the same level for 2024 as in 2023, with the maximum limit of annual variable remuneration being 150% of the annual fixed remuneration, which will be reached in the event of 100% achievement of the established objectives.

The maximum limit on short-term variable remuneration, as well as the level of achievement reached, shall be reported annually in the corresponding Annual Director and Officer Remuneration Report.

- The maximum limit of the annual variable remuneration is set at 150% of the fixed remuneration, which will be reached in the event of 100% achievement.

- Operation:

- The Remuneration Committee, in consultation with the Audit and Risk Supervision Committee and the Sustainable Development Committee, shall evaluate the performance of the officers, for which purposes it may rely on the advice of an independent expert, and it shall submit a reasoned proposal to the Board of Directors for approval thereof.

The Board of Directors, based on a proposal made by the Remuneration Committee, taking into account exceptional circumstances (including major corporate transactions) during the financial year, among other factors, shall have a margin of discretion in evaluating compliance with the indicators that could give rise to both upward and downward adjustments, and which in no case may give rise to a payment above the maximum approved for variable remuneration. Any use of this discretion must be justified and explained in the Annual Director and Officer Remuneration Report.

The annual variable remuneration of the Executive Chairman and of the Chief Executive Officer is paid entirely in cash once the annual financial statements have been audited and subsequently formulated by the Board of Directors.

If there is a restatement of the financial statements during the financial year following payment, the Board of Directors, based on any proposal made by the Remuneration Committee, may resolve to cancel pending payments (“malus” clauses) and claim the reimbursement of amounts delivered during the previous financial year (“clawback” clauses).

- The Remuneration Committee, in consultation with the Audit and Risk Supervision Committee and the Sustainable Development Committee, shall evaluate the performance of the officers, for which purposes it may rely on the advice of an independent expert, and it shall submit a reasoned proposal to the Board of Directors for approval thereof.

4.2.4. Long-term variable remuneration (strategic bonus): share delivery plans

- Purpose

- Long-term variable remuneration encourages commitment to the Iberdrola group’s business enterprise over the long term, linking a portion of remuneration to the creation of value for the stakeholders, as well as to the sustainable achievement of the strategic objectives of the Company and the maximisation of its social dividend and shareholder return.

It is implemented through share delivery plans linked to the achievement of long-term objectives, which are submitted for the ex ante approval of the shareholders at a General Shareholders’ Meeting, and which establish the maximum number of shares to be delivered to officers who are directors and also set the objective and quantifiable parameters determining the accrual thereof as well as their relative weighting.

These long-term plans typically have a duration of six years (three for performance evaluation and three for payment). Long-term variable remuneration plans are awarded every three years rather than annually, which ensures that there is no overlap.

As at the date of this Policy, the 2020-2022 Strategic Bonus is in the payment period (with two of the three scheduled deliveries having been made) and the 2023-2025 Strategic Bonus, which received 92% approval at the General Shareholders’ Meeting held on 28 April 2023, is in the evaluation period.

- Long-term variable remuneration encourages commitment to the Iberdrola group’s business enterprise over the long term, linking a portion of remuneration to the creation of value for the stakeholders, as well as to the sustainable achievement of the strategic objectives of the Company and the maximisation of its social dividend and shareholder return.

2020-2022 Strategic Bonus (during payment period)

2020

2021

2022

2023

2024

2025

6-year period

Evaluation period

√3

√3

√3

Grant

Payment period with malus and clawback clauses

-2025 Strategic Bonus (during payment period)

2023

2024

2025

2026

2027

2028

6-year period

Evaluation period

√3

√3

√3

Grant

Payment period with malus and clawback clauses

- Metrics

- Long-term variable remuneration is linked to the achievement of strategic, quantitative and qualitative, predetermined, specific, quantifiable, challenging and clear objectives (each parameter is assigned a specific weighting as well as a minimum level above which it is considered to be achieved and another level above which it is considered fully achieved), a description of which shall be provided in the Annual Director and Officer Remuneration Report:

- The 2020-2022 Strategic Bonus was approved at the General Shareholders’ Meeting held on 2 April 2020.

- The 2023-2025 Strategic Bonus was approved at the General Shareholders’ Meeting held on 28 April 2023.

- These metrics assume the achievement of the business strategy, interests and long-term sustainability of the Company.

- Long-term variable remuneration is linked to the achievement of strategic, quantitative and qualitative, predetermined, specific, quantifiable, challenging and clear objectives (each parameter is assigned a specific weighting as well as a minimum level above which it is considered to be achieved and another level above which it is considered fully achieved), a description of which shall be provided in the Annual Director and Officer Remuneration Report:

- Maximum amount

- Maximum number of shares to be delivered for the entire 2023-2025 Strategic Bonus:

- Executive chairman: up to a maximum of 1,900,000 shares.

- Chief executive officer: up to a maximum of 500,000 shares.

- These shares will be delivered through shares purchased in the market, and not through the issue of new shares.

- Maximum number of shares to be delivered for the entire 2023-2025 Strategic Bonus:

- Operation:

- Iberdrola’s long-term variable remuneration system has a duration of six years, of which the initial three-year period is the period for evaluating the performance level compared to the parameters to which the plan is linked, and the one comprising the next three financial years is its payment period, which occurs through the delivery of shares. Long-term variable remuneration plans are awarded every three years rather than annually, which ensures that there is no overlap between them.

Therefore, the delivery of shares under the multi-annual variable remuneration system is deferred for three years.

The Board of Directors, upon a proposal of the Remuneration Committee, which may be assisted by an independent expert, must evaluate the Company’s performance regarding the goals described above and determine the level of achievement thereof.

In order to engage in a proper overall evaluation of performance, circumstances occurring after the approval of each of the plans having a material impact, either positive or negative, on the main financial variables of the Company (including major corporate transactions) may be taken into account.

The level of achievement reached shall be reported in the corresponding Annual Director and Officer Remuneration Report.

At the end of the evaluation period for each of the incentive plans, the plan shall accrue annually in equal parts during the next three financial years. Each annual accrual and the corresponding payment thereof must be approved by the Board of Directors, after a report from the Remuneration Committee.

In this connection, during each of the three years of the accrual and payment period and for each delivery of shares, it is expected that there will be an evaluation whether to confirm or totally or partially cancel the corresponding payment and, if applicable, to claim the total or partial reimbursement of the shares already delivered (or the amount thereof in cash).

- Iberdrola’s long-term variable remuneration system has a duration of six years, of which the initial three-year period is the period for evaluating the performance level compared to the parameters to which the plan is linked, and the one comprising the next three financial years is its payment period, which occurs through the delivery of shares. Long-term variable remuneration plans are awarded every three years rather than annually, which ensures that there is no overlap between them.

4.2.5. Benefits

The officers are insured under a long-term savings scheme, implemented through an insurance policy that provides coverage for the supplementary social security contributions regime established to enhance the regime that would apply to them pursuant to applicable law and the Collective Bargaining Agreement.

This is a defined contribution plan applicable for retirement, death and disability for any reason, meaning that the officers will have the financial rights acquired at the normal retirement age, and the grounds for any early termination of the contractual relationship will determine the rights thereof. The policy expressly acknowledges that in the event of cessation of office or resignation or improper payment, the policyholder undertakes to pay the amount that has been surrendered under the policy in relation to the retirement contingency.

The chief executive officer is insured under the group life insurance policy described above, with an undertaking assumed when he was a member of senior management, and which has not been changed as a result of his appointment as chief executive officer.

The Company has no commitment to any long-term defined-contribution, defined-benefit retirement or savings system for the group of directors.

The executive chairman is not a participant in any long-term savings schemes (pensions).

The remuneration system for officers will be supplemented by health, life and accident insurance and other benefits in line with the practice followed in the market by comparable global companies.

The officers, as well as the rest of the Company’s professionals, are entitled to limited electricity discounts through rate concessions.

4.2.6. Malus and clawback clauses

As regards the long-term remuneration previously indicated in Section 4.2.4., the Board of Directors, with due regard to any proposal made by the Remuneration Committee, has the power to totally or partially cancel the payment of long-term variable remuneration or to demand the partial or total return of remuneration already paid.

These circumstances include the case of a material restatement during the next three financial years of the financial statements on which the Board of Directors based the evaluation of the performance level, provided that said restatement is confirmed by the external auditors and is not due to a change in accounting rules, as well as situations of fraud or serious violation of law declared by a final court judgement.

The procedure for the application and determination of the amounts or shares subject to cancellation or reimbursement, which includes a hearing, establishes a period of thirty (30) days for reimbursement to the Company.

4.2.7. Shareholding policy

The executive chairman and the chief executive officer may not transfer ownership of the shares received for a period of four years unless they maintain an amount equal to at least twice their fixed remuneration.

4.2.8. Remuneration for holding the position of director at other companies of the group that are not wholly owned

Officers who hold the position of director at companies that are not wholly owned by the Company, either directly or indirectly, may receive remuneration corresponding to the position from said companies in accordance with their corporate governance rules on the same terms as the other external directors.

4.2.9. Appointment of new officers who are directors

The remuneration of new officers who are directors shall conform to the provisions of the Remuneration Policy. The fixed remuneration shall be set on the date of their appointment, particularly taking into account their level of remuneration prior to their promotion or hiring, market terms and terms applicable to comparable positions, their experience and qualification level, and the duties assigned and responsibilities assumed.

New officers who are directors shall participate in annual and long-term incentives based on the same principles as those applicable to directors holding the position at the time of their appointment.

If a new director with executive duties joins the Company, the Company may offer incentives, in cash or shares, to compensate for variable remuneration or contractual rights forfeited upon leaving their office, subject to the maximum limits established by the shareholders at the General Shareholders’ Meeting.

5. Contract terms and conditions

The terms and conditions of the contracts of the officers are as follows:

- Duration

- The contracts of the Company’s officers are of indefinite duration.

- Applicable legal provisions

- The contracts with the officers of the Company are governed by the legal provisions applicable to senior officer special employment relationship agreements or by such special terms and conditions of the common employment system (régimen laboral común) as are determined by the Company or as legally apply from time to time.

The contracts with the executive chairman and the chief executive officer are governed by the legal provisions applicable in each case, based on commercial law.

- The contracts with the officers of the Company are governed by the legal provisions applicable to senior officer special employment relationship agreements or by such special terms and conditions of the common employment system (régimen laboral común) as are determined by the Company or as legally apply from time to time.

- Compliance with the Governance and Sustainability System

- All of the officers of the Company have the duty to strictly observe the rules and provisions contained in the Company’s Governance and Sustainability System to the extent applicable thereto.

- Non-compete clause

- The contracts with the officers in all cases establish a duty not to compete with respect to companies and activities that are similar in nature to those of the Company and of the other companies of the Group, during the term of their relationship with the Company and for a period of not less than one year following termination thereof, and also provide for consideration for each year of duration of such agreement not to compete.

The contractual relationship with the executive chairman establishes a duty not to compete with respect to companies and activities that are similar in nature to those of the Company during the term of his relationship with the Company and for a period of three years after the termination of the contract. In compensation for this commitment, he is entitled to a severance payment equal to two times annual remuneration.

In the case of the chief executive officer, during the term of the contract and for one year after the termination thereof. In compensation for this post-contractual commitment not to compete, he is entitled to compensation equal to one times annual his annual fixed remuneration, which is in any case included in the severance payment for termination of contract, if one exists.

- The contracts with the officers in all cases establish a duty not to compete with respect to companies and activities that are similar in nature to those of the Company and of the other companies of the Group, during the term of their relationship with the Company and for a period of not less than one year following termination thereof, and also provide for consideration for each year of duration of such agreement not to compete.

- Confidentiality and return of documents

- A rigorous duty of confidentiality is established, which must be assumed by the officer and complied with both during the term of the contract and once the relationship has terminated, with the Company reserving the right to bring such legal actions as may be appropriate to defend its interests. In addition, the officer must return to the Company any documents and items relating to the officer’s activity that are in the possession thereof upon termination of the relationship with the Company, in accordance with such terms and conditions as are set forth by the Company.

- Indemnification

- The contracts of the officers contemplate financial compensation in the event of termination of the contractual relationship with the Company, provided that such termination does not occur exclusively due to the professional’s decision to withdraw or as a result of a breach of the duties thereof. The amount of the severance payment is established in accordance with length of service and the reasons for the professional’s cessation of office, up to a maximum of five times annual salary.

Since 2011, for new contracts signed with officers, the limit on the amount of the severance payment is two times annual remuneration, and as at 31 December 2023, there are a total of 12 contracts with a severance limit higher than two times annual remuneration, which means that from 2001 to 31 December 2023, the number of officers with a severance limit higher than two times annual remuneration was reduced by more than 100.

When the current executive chairman joined the Company in 2001, the Company included clauses in the contracts with its key officers providing for severance pay of up to five times annual salary in order to achieve an effective and sufficient level of loyalty. Although the treatment in effect for such officers was applied to him at that time, he would currently be entitled to two times annual remuneration as severance pay for instances in which a severance payment was required for termination of contract.

The chief executive officer is entitled to receive severance pay equivalent to two times annual remuneration in the event of termination of his relationship with the Company, provided that said termination is not due to a breach attributable to the beneficiary or solely due to a voluntary decision thereof. This severance payment for termination of contract includes compensation for the commitment not to compete.

- The contracts of the officers contemplate financial compensation in the event of termination of the contractual relationship with the Company, provided that such termination does not occur exclusively due to the professional’s decision to withdraw or as a result of a breach of the duties thereof. The amount of the severance payment is established in accordance with length of service and the reasons for the professional’s cessation of office, up to a maximum of five times annual salary.

- Application of “malus” and “clawback” clauses

- Provided for in contracts with officers of the Company, for both short-term variable remuneration and long-term variable remuneration.

6. Alignment with business strategy, interests and long-term sustainability

The following features of the Policy ensure consistency with long-term strategy, interests and sustainability focused on the achievement of long-term results:

- Total remuneration of the officers is mainly composed of: (i) fixed remuneration (ii) short-term variable remuneration (annual bonus) and (iii) long-term variable remuneration (strategic bonus).

- The total remuneration is designed to attract and retain the best talent and align their performance with the interests of the Iberdrola group and the achievement of its business strategy, promoting its long-term sustainability, in accordance with best practices.

- An appropriate balance between fixed and variable components of remuneration is established: officers have a variable remuneration system with risk measures ensuring that no variable remuneration is paid if they do not meet the minimum achievement threshold.

- The weighting of variable remuneration, both short and long-term, for the 2024 annual amount within a scenario of maximum target achievement is 81% for the executive chairman and 76% for the chief executive officer. The above “pay for performance” percentages are for remuneration based on the achievement of targets linked to the business strategy and to the interests and long-term sustainability of the Company.

- The long-term incentives (described in Section 4.2.4 above) are designed as a multi-annual plan with deferred delivery of shares that is intended to encourage commitment to the Iberdrola group’s long-term strategic goals, aligning a portion of remuneration to the creation of value and shareholder return, as well as to the sustainable achievement of the strategic objectives of the Company and the maximisation of its social dividend.

- The officers may not transfer ownership of the shares received for a period of four years unless they maintain an amount equal to at least twice their annual fixed remuneration (shareholding policy).

- Both short- and long-term variable remuneration is subject to the application of clauses for the cancellation (“malus”) or clawback of variable remuneration, as described in Section 4.2.6 of this Policy.

In addition, the following measures allow for a reduction in exposure to excessive risks and strengthen alignment with the long-term objectives, values and interests of the Company:

- Iberdrola’s Remuneration Committee is currently made up of three members, 67% of whom are independent directors (two members) and 33% of whom are other external directors (one member).

- The Remuneration Committee is responsible for proposing, reviewing, analysing and implementing the Director Remuneration Policy.

- The Company’s Audit and Risk Supervision Committee participates in the process of evaluating whether the remuneration system encourages excessive or inappropriate risk-taking. This evaluation takes into account the nature of Iberdrola’s risks in the design of variable remuneration plans.

- The Sustainable Development Committee participates in the process of evaluating the appropriate transposition of the Company’s sustainable development strategy, with particular emphasis on environmental, social and corporate governance and regulatory compliance policies in the remuneration system. This evaluation takes into account Iberdrola’s commitment to sustainable development in the design of variable remuneration plans.

- There is no guaranteed variable remuneration with risk measures for which reason no variable remuneration is paid if the minimum achievement threshold is not met.

7. Consideration of the terms and conditions of remuneration and employment of the Company’s professionals

People fundamentally determine the difference between competitive companies and those that are not, as well as between those that sustainably create value and those that gradually lose their ability to generate wealth.

In this regard, Iberdrola’s management model promotes not only the physical and mental well-being of its professionals, but also an adequate, pleasant, satisfactory and stimulating working environment that generates confidence and motivation, promoting professional and personal development of the workforce, which results in greater creativity and productivity, thus contributing to the achievement of business objectives and long-term sustainability.

The Company’s individual employee value proposition favours the selection, hiring, promotion and retention of talent, consisting of competitive remuneration for the creation of value and a diverse and inclusive work environment that facilitates reconciliation between personal and working life and promotes the professional growth of the Company’s workforce.

This professional growth must be based on objective performance standards, equal opportunity, and a commitment to the Purpose and Values of the Iberdrola group and to the business enterprise established at the Group level.

The Remuneration Committee regularly reviews the general remuneration programmes for the professionals of the group, evaluating the adequacy and results thereof, and takes them into account when determining the Director Remuneration Policy.

The remuneration systems for the Company’s professionals share the principles of the Director Remuneration Policy, and their purpose is to attract, retain and motivate the most qualified professionals so that the Company and the other companies of the group can meet their strategic objectives within an increasingly competitive and globalised framework, continuing with their leadership commitment in the energy sector, all within a framework of non-discrimination.

The Remuneration Committee considers it a priority for the remuneration system to promote the strengthening of its human capital, as the main factor differentiating it from its competitors.

The principles of conduct informing the remuneration systems are:

- Favour the attraction, hiring and retention of the best professionals.

- Maintain consistency between strategic positioning at the group level and its development, its international and multicultural reality, as well as its objective of excellence.

- Recognise and reward the dedication, responsibility and performance of all its professionals.

- Adjust to the various local circumstances in which the different companies of the group operate.

- Be and stay at the forefront of the market, consistently with the position achieved by the Company and the other companies of the group.

8. Temporary exceptions

Pursuant to the provisions of Section 529 novodecies.6. of the Companies Act, the Board of Directors, after a favourable report from the Remuneration Committee, may apply temporary exceptions to the variable components of remuneration (both short- and long-term) of the officers when exceptional circumstances so require to serve the long-term interests and the sustainability of the Company as a whole or to ensure the viability thereof.

The temporary exception to the variable components of remuneration (both short- and long-term) may result in both upward and downward adjustments, and in no case may it result in a payment in excess of the maximum approved variable remuneration. Any use of this temporary exception should be justified and explained in the Annual Director and Officer Remuneration Report.

9. Governance of the Policy

The decision-making process for the determination, review and implementation of the Policy is described below.

- General Shareholders’ Meeting

- Approves the Director Remuneration Policy, which constitutes the Company’s highest-level set of regulations on director remuneration after the By-Laws.

- Approves the remuneration of the directors consisting of the delivery of shares of the Company or of any options thereon or which is indexed to the price of the Company’s shares.

- Board of Directors

- Upon a proposal of the Remuneration Committee, proposes the Director Remuneration Policy to the shareholders for approval on the terms established by law and the Governance and Sustainability System.

- Upon a proposal of the Remuneration Committee, approves the remuneration of the directors in accordance with the provisions of law and the Director Remuneration Policy.

- Upon a proposal of the Remuneration Committee, proposes variable share-based remuneration plans for approval by the shareholders at a General Shareholders’ Meeting.

- Upon a proposal of the Remuneration Committee, approves the performance of the officers in short-term variable remuneration.

- Upon a proposal of the Remuneration Committee, approves the performance of the Company in long-term variable remuneration.

- Remuneration Committee

- Submits the proposed Director Remuneration Policy to the Board of Directors for approval and subsequent submission to the shareholders at the General Shareholders’ Meeting, issuing the corresponding specific explanatory report required by Section 529 novodecies of the Companies Act.

- Regularly reviews the Director Remuneration Policy, proposing to the Board of Directors any amendment and update thereof and reporting thereto on any issues that may arise in connection with the interpretation and application of said Policy and standards. In the process of reviewing the Policy, the Remuneration Committee considers employee remuneration and how remuneration is aligned with the Purpose and Values of Iberdrola.

- Proposes to the Board of Directors the system and amount of the annual remuneration of the directors, as well as the individual remuneration of the officers and the other terms and conditions of their contracts, including fixed remuneration, annual or multi-annual variable remuneration, incentive plans and strategic bonuses in shares and any potential compensation or severance payment that may be established in the event of removal, in all cases in accordance with the provisions of the Governance and Sustainability System and of the Director Remuneration Policy.

- Endeavours to ensure that the Board of Directors is in a position to approve in advance the application, objectives, standards and metrics of the various items of remuneration established for the current financial year in accordance with the Policy approved by the shareholders at the General Shareholders’ Meeting.

- Ensures that the Board of Directors is in a position to evaluate the achievement of the objectives, standards and metrics established during the previous year to determine the variable remuneration earned by the officers in that year sufficiently in advance. And, if applicable, for short- and long-term variable remuneration, proposes to the Board the cancellation or reimbursement of remuneration that has been paid to the respective beneficiaries.

- In consultation with other committees, particularly the Audit and Risk Supervision Committee, the Remuneration Committee evaluates whether the remuneration system encourages excessive or inappropriate risk-taking. This evaluation takes into account the nature of Iberdrola’s risks in the design of variable remuneration plans.

- In consultation with other committees, particularly the Sustainable Development Committee, the Remuneration Committee evaluates the appropriate transposition of the Company’s sustainable development strategy, with particular emphasis on environmental, social and corporate governance and regulatory compliance policies in the remuneration system. This evaluation takes into account Iberdrola’s commitment to sustainable development in the design of variable remuneration plans.

- Annually verifies, on the basis of information provided to the Remuneration Committee, that the remuneration policies for directors and officers are properly applied, that no payments are made that are not provided for therein, whether circumstances have arisen that justify the application of “malus” (cancellation) or “clawback” (reimbursement) clauses, and propose, if appropriate, suitable measures to recover any amounts that may be due.

- Endeavours to ensure compliance with the remuneration programmes of the Company and reports on the documents to be approved by the Board of Directors regarding remuneration, including the Annual Director and Officer Remuneration Report and the corresponding sections of the Company’s Annual Corporate Governance Report.

- Regularly reviews the general remuneration programmes for the group’s professionals, assessing the suitability and results thereof, considering that they promote physical, mental and emotional well-being, as well as a healthy, safe, pleasant, diverse and inclusive working environment.

- External advisors of the Remuneration Committee

- Performs an appropriate assessment of the independence of the external advisor if the participation thereof is required for the preparation of the Director Remuneration Policy.

- Seeks the help or advice of external professionals, who must address their reports directly to the chair of the Remuneration Committee, endeavouring to ensure that any possible conflicts of interest do not prejudice the independence of the external advice received.

- Interaction of the Remuneration Committee

- In the performance of its duties, the Remuneration Committee works proactively and in consultation with other committees, particularly the Audit and Risk Supervision Committee, the Sustainable Development Committee and the Appointments Committee.

10. Effectiveness

This Director Remuneration Policy shall be in effect as from the date of approval hereof by the shareholders acting at the General Shareholders’ Meeting and during financial years 2025, 2026 and 2027.

* * *

The Director Remuneration Policy was initially approved by the Board of Directors on 18 December 2007 and was last approved by the shareholders at the Company’s General Shareholders’ Meeting held on 17 May 2024.

Shareholders

Board of Directors

Remuneration Committee

Sustainable Development Committee

Executive Committee

Audit and Risk Supervision Committee

Appointments Committee

Officers

External independent consultants

- Reporting

- Consultation

- Technical support

10. Effectiveness

This Director Remuneration Policy shall be in effect as from the date of approval hereof by the shareholders acting at the General Shareholders’ Meeting and during financial years 2025, 2026 and 2027.

* * *

The Director Remuneration Policy was initially approved by the Board of Directors on 18 December 2007 and was last approved by the shareholders at the Company’s General Shareholders’ Meeting held on 17 May 2024.